SmarDex: Revolutionizing DeFi and Dominating the Stablecoin Market

SmarDex is a DeFi platform offering a stablecoin (USDN) and a decentralized exchange with innovative features like Volatility Vaults to mitigate impermanent loss and bridge traditional finance with DeFi.

You almost never start valuing a company or stock with a blank slate.

All too often, your views on a company or stock are formed before you start inputting the numbers into the models and metrics that you use and, not surprisingly, your conclusions tend to reflect your biases.

Professor Aswath Damodaran

Executive Summary

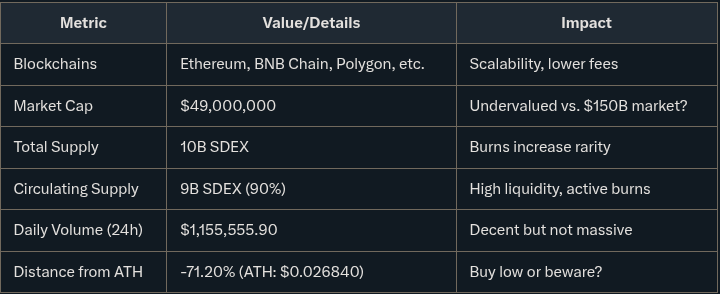

SmarDex (SDEX)is a decentralized exchange (DEX) tackling impermanent loss (IL)—a major pain point for liquidity providers (LPs). Launched in 2023, it’s already multi-chain and introduced USDN, its decentralized stablecoin, in January 2025. With a $49M market cap and $3.4M TVL, it’s small compared to Ethena’s $6.1B TVL. Can it carve out a niche? What do you think?

Overview

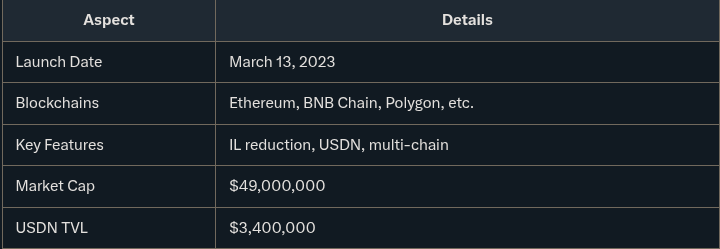

SmarDex kicked off in Switzerland on March 13, 2023, aiming to shake up DeFi with its IL-reducing algorithms. It’s live on Ethereum, BNB Chain, Polygon, Arbitrum, and Base, offering trading, staking, and liquidity via SDEX and USDN. Here’s a snapshot:

Question: Could SmarDex be DeFi’s next breakout star?

What Problems Does It Solve?

SmarDex targets key DeFi challenges:

- Impermanent Loss: Reduces IL, letting LPs keep more profits.

- Stablecoin Trust: USDN offers a decentralized alternative to centralized stablecoins like USDT.

- Scalability: Multi-chain support cuts fees and boosts access.

- Market Share: Aims at the $150B+ stablecoin market—big dreams!

🚨 Two things everyone tried tor create but no one succeeded:

— WhalePump Reborn (@WhalePumpReborn) August 19, 2024

1. A decentralized Perpetual ETH with native on-chain leverage

2. A decentralized Synthetic Dollar with intrinsic yield@SmarDex is doing both, powered by $SDEX.

Don't miss out.

DeFi season loading. https://t.co/KT5CQYx9po

What Is the Endgame?

SmarDex wants to blend Uniswap’s liquidity dominance with MakerDAO’s stablecoin stability, using IL reduction and USDN as its edge. Success could transform how liquidity works in DeFi. Ambitious enough for you?

Who Is the Team?

Led by EPFL researchers and Jean Rausis and Eric Rabl the team brings serious DeFi chops. Audits by Trail of Bits and Paladin add trust, and a $4.5M seed round from RA2 TECH (Dec 2024) shows early backing. Check the Appendix for more.

Key Metrics

Low volume—dealbreaker or opportunity?

Utility

- Governance: SDEX holders will be able to vote on fees and upgrades (DAO soon).

- Staking: No-lock staking.

- Revenue Sharing: ~0.07% fees fund buybacks—benefits holders.

- LP Membership: Earn SDEX as an LP—tempting?

- Fee Payments: Fees burn SDEX—supply shrinks over time.

Source: SmarDex Docs

Availability On Exchanges

SDEX trades on MEXC,Gate.io, Uniswap V3, Bitget, Swissborg and BitMart with $1.15M daily volume. No perpetual futures yet. Compare that to Uniswap’s $1B+ daily—room to grow?

Fundraise & Investors

- Seed Round: $4.5M from RA2 TECH (Dec 2024)—early believer vibes.

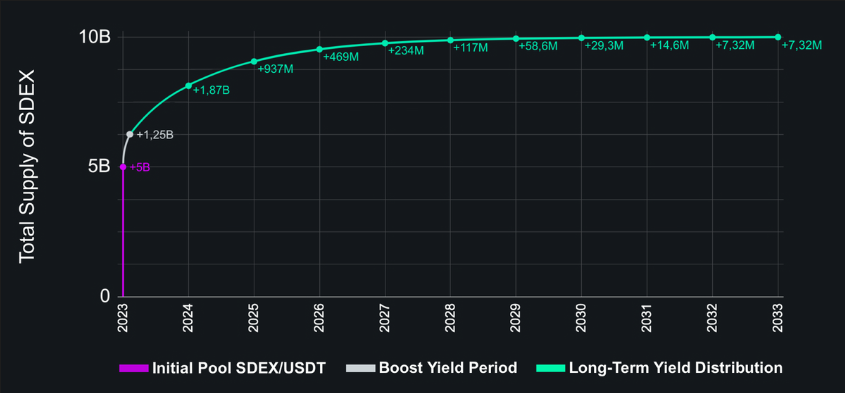

- Token Unlocks: 9 billion SDEX are in circulation out of 10 billion

Roadmap & Milestones

- Q2 2025: USDN expansion—TVL boost incoming?

- Track Record: USDN launched on time—team delivers.

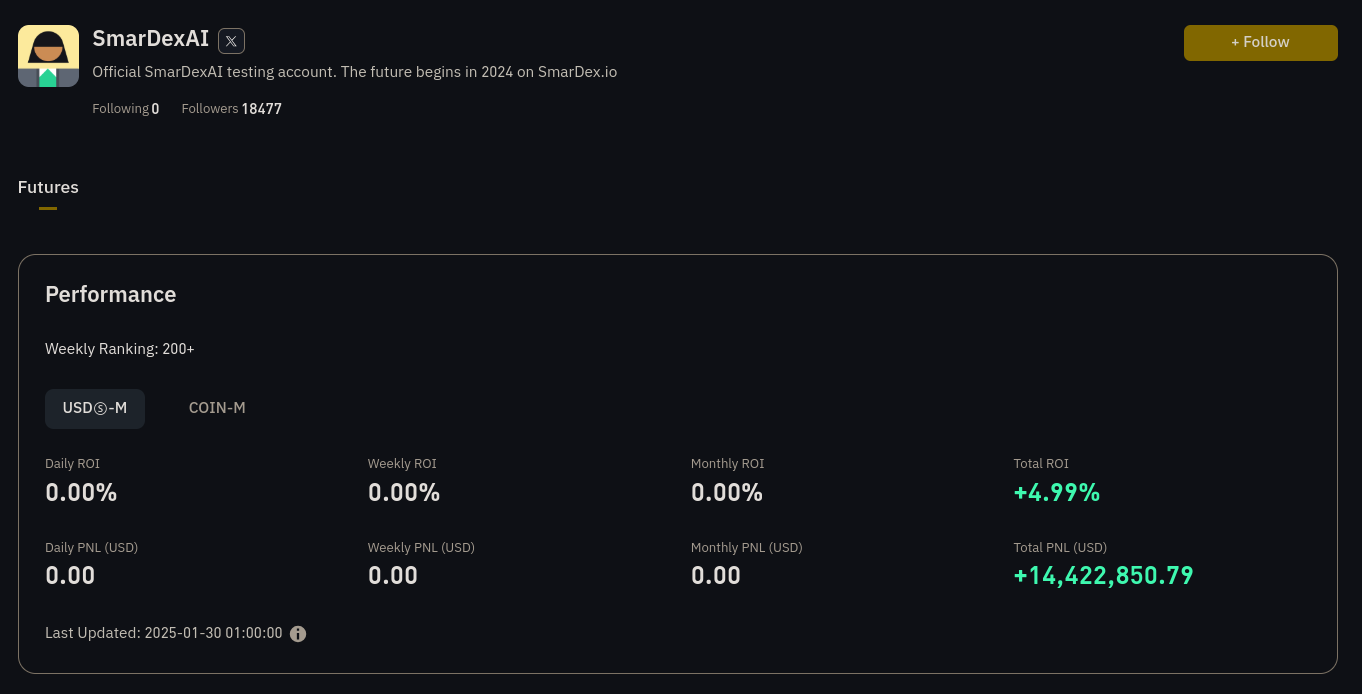

Futures: game-changer or hype?

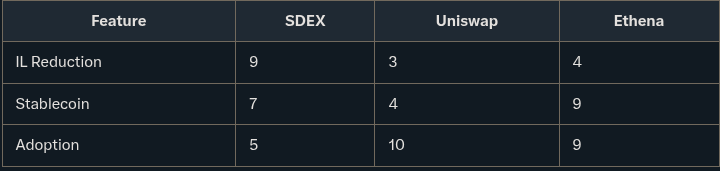

Competitive Analysis

Did you know? Ethena's 'decentralized synthethic dollar' is not decentralized and isn't a synthetic dollar but a synthetic USDT.

— SMARDEX.io (@SmarDex) June 11, 2024

Basically, USDe is USDT with many risks on top.

Dependency on USDT, Not USD: A Critical Risk for USDe

Ethena’s USDe is not directly tied to the US… pic.twitter.com/X0gDv81emB

Potential Concerns & Risks

- Competition: Uniswap and Ethena dominate

- Adoption: USDN needs traction

- Regulation: Stablecoin rules could hit USDN

- Tech Risks: Bugs are possible, though audits help.

Thesis / Summary

SDEX sits at $49M—undervalued? I think SmarDex could attract add more TVL given it's important yield in a 150 billion stablecoin industry.Where does USDN yield come from?

Where does USDN yield come from?

https://x.com/SmarDex/status/1904917012876321070

Let’s talk about $USDN, a fancy way to have stable dollars while earning yield (a.k.a. free money). 🥰

— SMARDEX.io (@SmarDex) January 28, 2025

But where does that yield actually come from? Is it magic? Is it sketchy? Sir, what about LUNA????!!

Let’s dive into how USDN generates yield and why it’s a secure and… pic.twitter.com/rou6K3MkIY

Fundamentals

- Network: EVM-based—SDEX powers governance and fees.

- Story: EPFL-backed IL killer—disruptive potential.

- Data: $49M cap, 90% circulating—burns add scarcity.

News / Catalysts and Social Media & Growth

- Recent: $4.5M seed, USDN launch—TVL rises, price lags.

- Future: Perpetual futures (Q3 2025)—volume spike ahead?

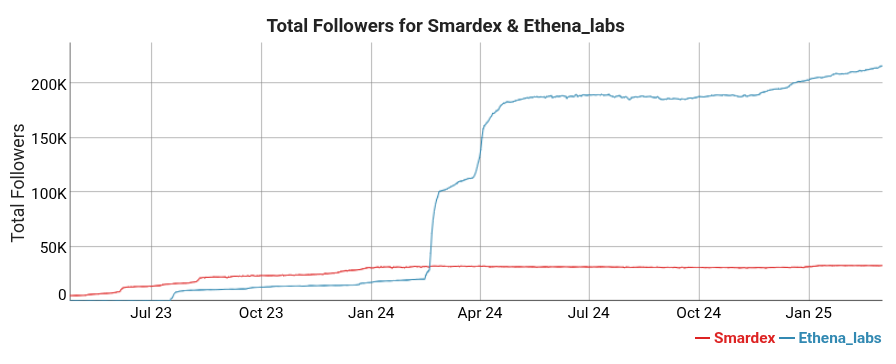

- Socials : growing quietly.Socials:@SmarDexorTelegramorSmardex Q&A

- Buzz: “SmarDex: IL Killer?” (X, Feb 28)—underrated chatter.

Visual idea: TVL growth chart—want to see it?

Tools for Monitoring

- Metrics:Watch USDN TVL on DefiLlama

Sources

Appendix

- Team:@SmarDexJean(co-founder),@SmarDexEric, EPFL researchers—full bios at Sources.

- Tokenomics: 10B supply, 70% community-held—burns drive value.

Impermanent loss

Impermanent loss happens when you provide liquidity to a pool, and the value of your deposited assets changes compared to the market.

Example:

You deposit 1 ETH and 100 DAI in a liquidity pool (assume 1 ETH = 100 DAI). If ETH price increases to 200 DAI, the pool automatically rebalances, and you might end up with 0.7 ETH and 140 DAI when you withdraw. This is because the pool sold some of your ETH to buy more DAI to maintain a 50/50 value ratio.

If you had just held onto your 1 ETH and 100 DAI, you'd have a higher value now. This difference is called impermanent loss.

It's called "impermanent" because the loss is only realized when you withdraw your liquidity. If the prices return to the initial ratio, there's no loss.

- Healty tokenomics : No ponzinomics here! Farming revenues are boosted, attracting Liquidity Providers (LPs). USDN yield com from funding rates and Staked Ethereum in this way Smardex can gain market share by being attractive for Liquidity Providers.

What's the point of having USDT when you can have yield directly inside your wallet?

- Growing TVL (Total Value Locked)

TVL (Total Value Locked)

TVL (Total Value Locked) is the total value of crypto assets deposited in a DeFi protocol.

What it tells you:

- Popularity and health: Higher TVL usually means a protocol is doing well.

- Market share: Helps compare protocols.

- ETH perpetual contracts, more perpetual contracts soon!

- And even more to come with Smardex AI : Personal Financial Advisor (made in collaboration with WhalePump).

Where to buy SDEX ? BitGet (affiliated link) or Swissborg for an easier interface (if you live in Europe).

This is my analysis, please DYOR (Do Your Own Analysis) before buying an asset.

Comments ()